Subcontract Requirements

Form DOT-202 →

This form must be signed by the prime contractor and sent to the address listed in the lower left-hand corner of the form PRIOR to such sublet work being performed. If a subcontractor plans to sublet a portion of their work, the Request to Sublet Work form must be signed by the PRIME CONTRACTOR then submitted to the DOT.

The SDDOT Subletting of Contract Standard Specification, Section 8.1 stipulates the requirements for obtaining written consent to sublet work, limits the percent of work that may be sublet, defines what the Department will not consider as subcontracting and defines the project limits.

FHWA-1273

SD-1273

A breach of any of the stipulations contained in these Required Contract Provisions may be sufficient grounds for withholding of progress payments, withholding of final payment, termination of the contract, suspension / debarment or any other action determined to be appropriate by the contracting agency and FHWA, as stipulated in Section I(3) of the FHWA-1273.

SDDOT Labor Compliance Information

SDDOT Statement of Compliance form

The South Dakota Department of Transportation, as the contracting agency, has the responsibility and authority to monitor and enforce compliance with the labor provisions contained in the department's Federal-aid construction contracts exceeding $2,000 and in the non-Federal funded construction contracts where the award meets or exceeds $100,000. The labor provisions also apply to all related subcontracts of the Federal-aid and non-Federal funded highway construction contracts.

The Davis-Bacon & Related Acts (DBRA) labor provisions apply to all mechanics and laborers working on the site of the work. Contractors and subcontractors that have laborers and mechanics working on the site of the work must ensure that:

- The employees will be paid unconditionally and not less often than once a week; and

- The employers will not withhold unauthorized payments from the employees' wages [except payroll deductions permitted by 29 CFR 3]; and

- The payments shall be computed at not less than the wage rates contained in the contract for the actual types of work performed by the employees, without regard to skill; and

- Overtime compensation shall be paid at a rate not less than one-and-one-half times his/her basic rate of pay for all hours worked in excess of 40 hours in a work week; and

- The full amount of wages and bona fide fringe benefits (or cash equivalents) due to the employees shall be paid to the employees within seven days following the end of each such work week.

For additional information, please visit: Federal Rules and Regulations 29 CFR Part 1, Part 3 and Part 5 (Federal Davis Bacon and Related Acts)

Any failure by an employer to compensate an employee for all hours worked at no less than the prevailing/required minimum wage rate, plus warranted overtime, should be reported to the Labor Compliance Officer below.

Contact

© 2026 State of South Dakota. All Rights Reserved.

Becker-Hansen Building

700 E. Broadway Ave.

Pierre, SD 57501

Modern Logic

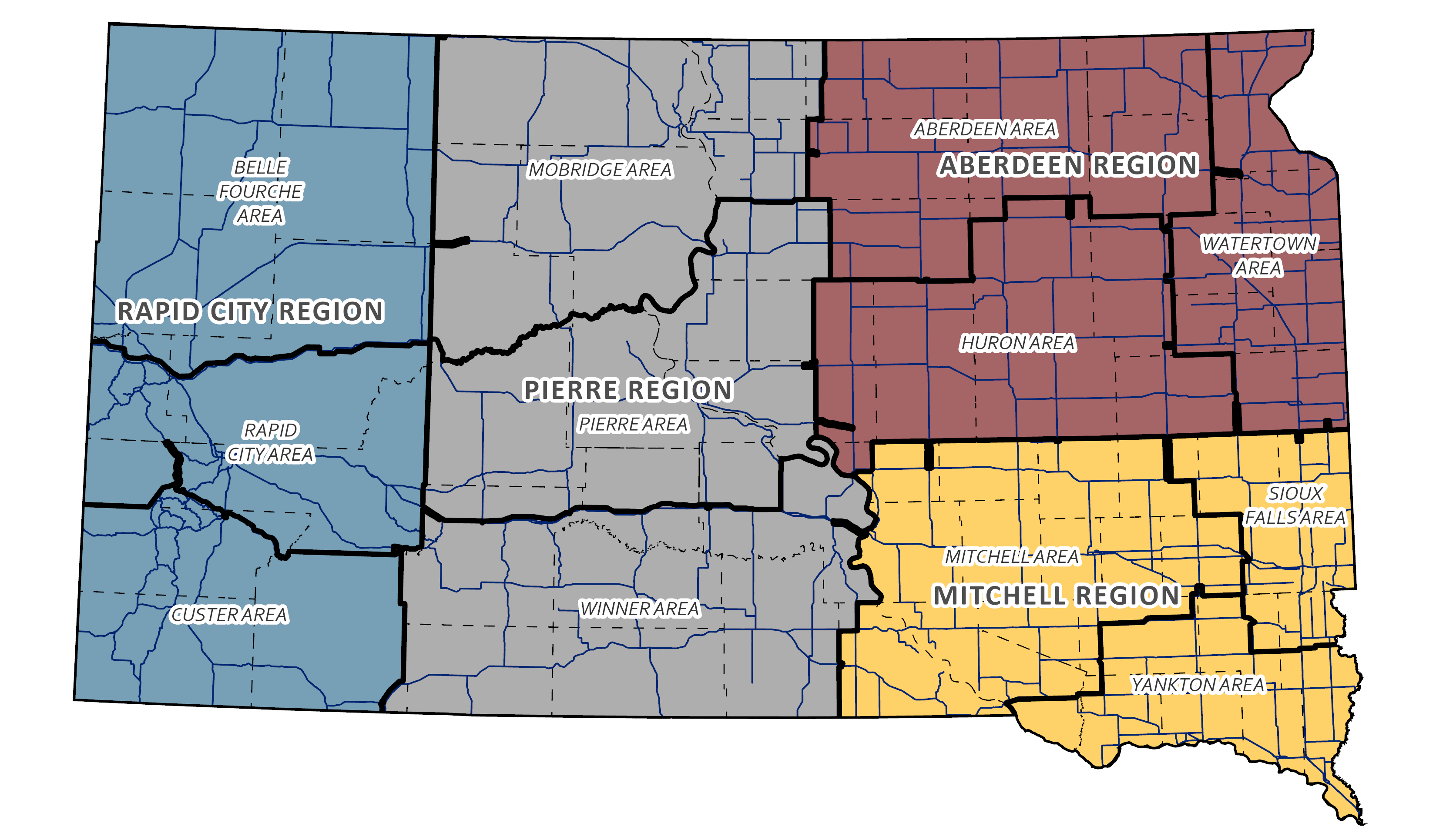

Region & Area Offices

Travelers

© 2026 State of South Dakota. All Rights Reserved.

Becker-Hansen Building

700 E. Broadway Ave.

Pierre, SD 57501

Modern Logic